GREEN APPLE CASH: MERCHANT PROGRAM

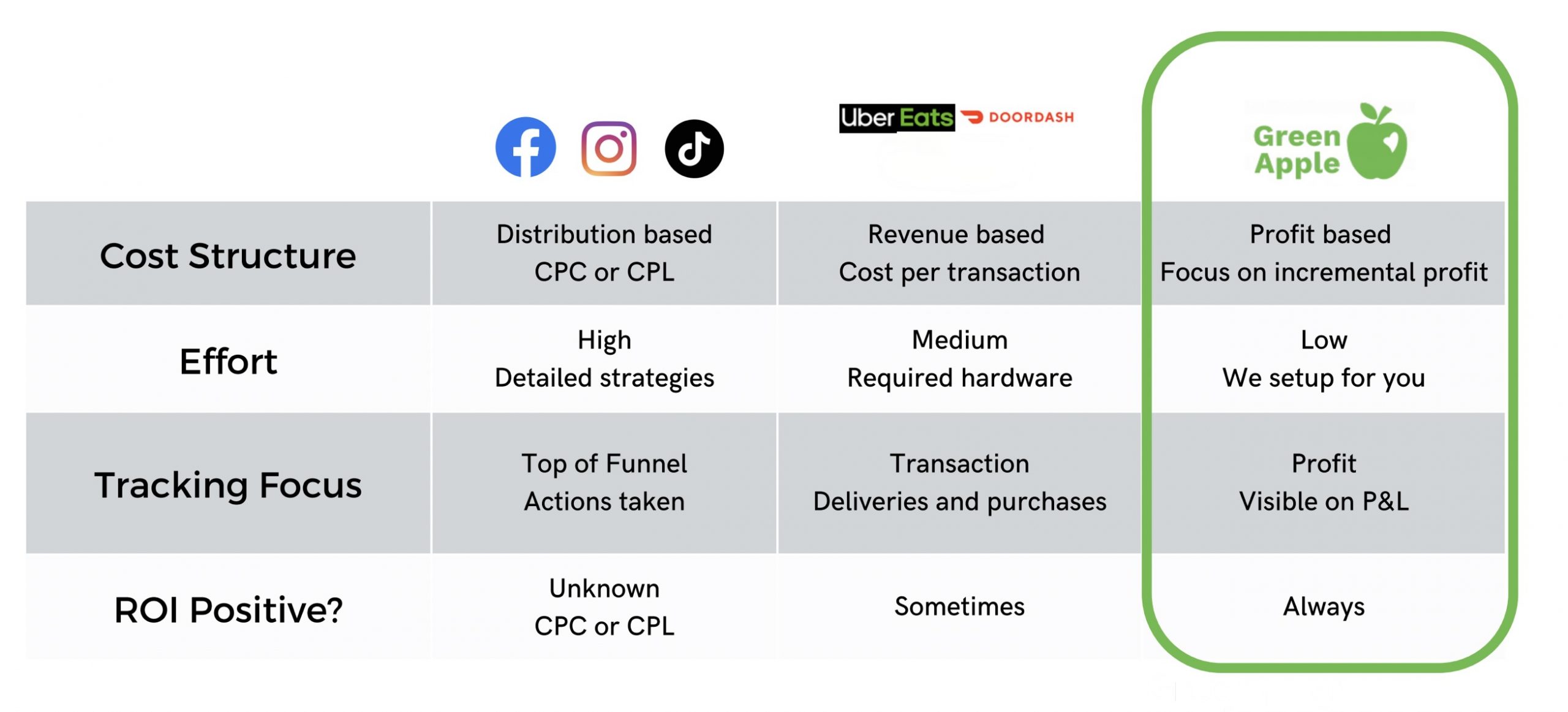

Why local merchants are choosing Green Apple to engage with their consumers, attract new clientele and grow revenue.

GREEN APPLE GIVES: MERCHANT PROGRAM

Guaranteed profits, new customers and community altruism.

Learn why local merchants are choosing Green Apple to engage and give back.

Drives new customers

Connect with new customers through Green Apple's network of over 1.5M consumers

Increased

Profits

Businesses see a 75% increase in spending and return visits from using Green Apple cashback

Quick & Easy integration

You don't change anything!

Keep your existing POS hardware, software and merchant service provider!

Support causes close to your

heart, while also engaging customers.

Brands on the platform

How to get started:

Sign Up

Select your offer

We bring you customers

Customer shop as normal

Watch your revenue grow

How to get started:

Sign Up

Select your offer

We bring you customers

Customer shop as normal

Watch your revenue grow

FAQs

A: We suggest 90 days for offers, with opportunity to amend offers after the 90 days.

A: Typical cashback ranges from 5-20% of the transaction value. We recommend configuring an offer’s minimum spend such that it’s reward is no less than $1 cashback.

A: Yes, it is $100.

A: Green Apple charges a one-time setup fee, a monthly service fee and a small cashback marketing fee. Please speak with our sales or success teams for more details.

A: If there is unused budget it is fully refundable (not charged).

A: There is no limit to how often a merchant can change the offer available to consumers. This is achieved by using expiry dates on offers so that a new offer starts when the previous ends. However, we suggest letting the offer run for 90 days before making any changes.

A: No, as transactions are attached to a Merchant ID, not specific SKU data. We can present offers in such a way that they promote a certain category spend.

A: Yes offers can be for 1 or more specific days of the week in combo with a time window.

A: Yes and the budget can be set two ways: 1)By dollar amount. Set total spend for the offer period, the offer turns off when budget is reached. 2)By offer redemptions. Set total number of redemptions allowed. Better for % based offers where preference is a minimum audience vs minimum total spend.

A: Due to the nature of cashback offers being redeemed in real time, we typically take a deposit against the campaign’s cashback budget to ensure consumers get their cashback immediately. Retailers typically get invoiced monthly based on the transaction volume. Custom payment programs can be developed where needed.

A: While Green Apple uses transaction authorization data to calculate cashback, there is a secondary check against settlement data for returns that occur over the next 30 days, and that are not paid back to the user as in-store credit (i.e. it has to be a cash refund). Cashback applied to a user’s account is recovered from amounts on their next reward earnings (regardless of merchant) by Green Apple.

A: No. Because the order transaction was processed through the 3rd party delivery app which is a different merchant account than yours, you do not pay cashback on those purchases.

1) Green Apple is a cashback rewards loyalty NETWORK so you can promote your business to consumers in the network with all the other businesses. The more businesses on the network and the more consumers they add to the network, increases the “network effects” of being part of the program. “A rising tide floats all boats”

NOTE: This is the same advantage that Big Retail uses with their participation in big loyalty networks like Scene+, PC Optimum, Triangle, Aeroplan, Air Miles, Rakuten and more!

2) Green Apple is also used as a loyalty reward program for your existing customers so you can drive increased sales. Our client success team with work with you to update your cashback offers over time to “gamify” your rewards and drive repeat sales.

3) We use advanced card-linking technology for a frictionless user experience. For consumers, there are no loyalty cards to show, no QR codes or apps to scan nor any check-out codes required. For your business, there are NO changes to your POS system, your software or your merchant service provider.

NOTE: Your offer is created and hosted in the “Cloud” and Green Apple uses the transaction data between a credit card and your merchant account to activate the cashback reward redemption automatically. Customers just tap to pay with their credit card as always and Green Apple Takes care of the rest.

4) Offers can be designed to solve for your specific retail initiatives such as increase purchase frequency, increase average spend, minimum spend requirements, etc. and our client success team will work with you to update and optimize your offers over time.

5) Green Apple has full flexibility on the “style” of the offer which is unique in the industry. For example “Get 10% cashback when you cumulatively spend $250 or more at Big John’s Restaurant in January”

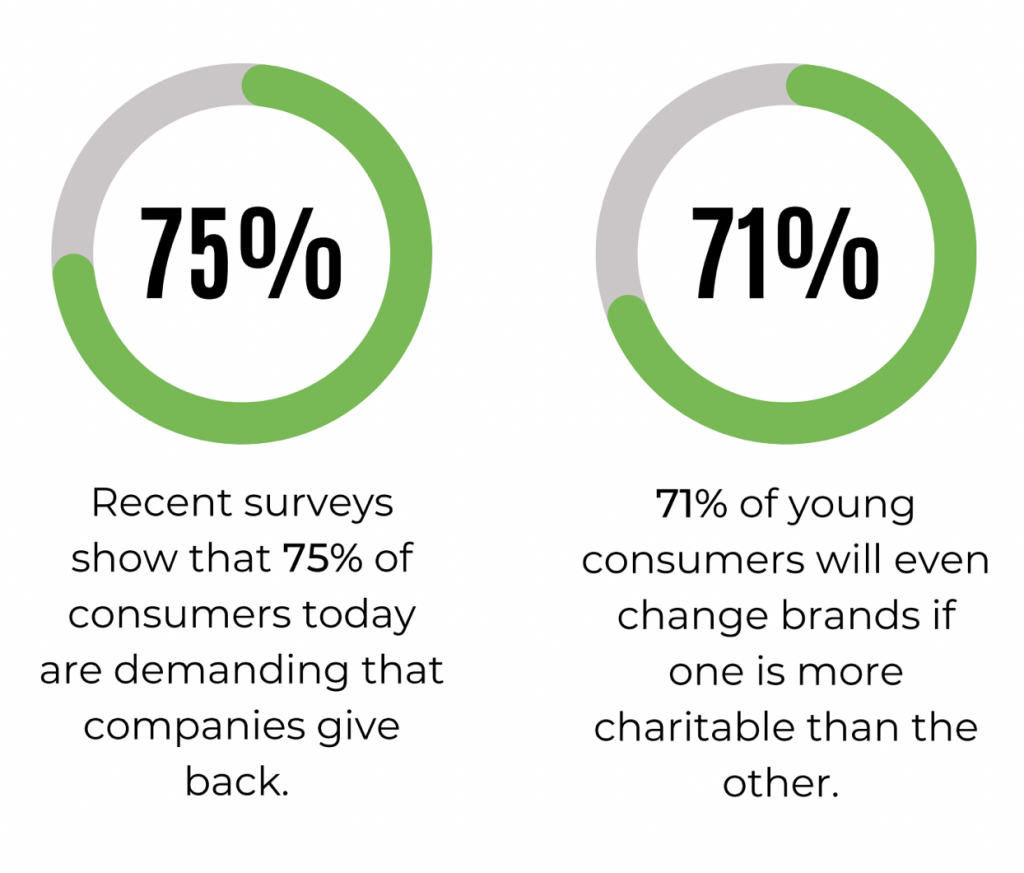

A: Consumers of all types although the nature of this technology, integrated into a consumers’ life this way, is adopted and appreciated most by those in the 21-39 age bracket, predominantly Millennials and early GenZ.

A: Nope! We will help you get your offers up on the platform for you. All it takes is a 5 minute call with our customer success team. There is no equipment to buy, no software to download and no changes to your merchant provider or account.

A: Typically, merchants sign for a year with a minimum 90-day period for offers. Cancellations with 90 days notice.

A: Please contact our sales team for more details info@cashcloud.co